Transforming esure's Digital Insurance Experience

The Challenge

Following an acquisition by Bain Capital, esure embarked on a multi-year digital transformation to overhaul their digital operations, respond to incoming legislation limiting price-walking, and reduce their costs to serve customers via a core digital platform that would support sales, customer service, and claims.

Our Approach

As contractors for HYD, we contributed expertise in user research, agile transformation, rapid prototyping, and product definition to help shape and deliver the vision for transforming esure.

We undertook comprehensive user research, including qualitative interviews and usability testing, to understand customer expectations for modern insurance products. This research informed the esure Flex proposition, aimed at delivering a highly personalised, competitively priced insurance option. Rapid prototyping enabled us to refine the product based on real-time user feedback, ensuring the final offering resonated well with its audience.

Working with the executive team, we supported esure’s organisational transformation with new methodologies and frameworks to make it easier to deliver agile digital products. We also supported them with new hires of permanent staff into their digital teams.

Once the core product proposition was defined, we collaborated with esure’s internal teams and EY, their technology partner, to translate our insights into actionable technology requirements. These requirements underpinned the development of the new cloud-native platform esure was building to replace its legacy systems, ensuring the work done by EY aligned closely with esure Flex’s customer-focused goals.

Results

Building on these new digital ways of working, we supported the team in developing esure Flex, a new car insurance proposition designed to help esure comply with incoming legislation. The product was designed to meet the growing demand for affordable, customisable insurance options, relying on advanced technology to keep operational costs low.

The launch of esure Flex drove impressive growth, with over 330,000 new policies issued by 2023. The shift to a modern, cloud-native platform—developed in partnership with EY—allowed esure to scale effectively while keeping operations lean.

Key Outcomes

- Over 330,000 new policies issued by 2023

- Over 90% of all claims can now be initiated online

- Improved operational efficiency and customer satisfaction

- Enhanced pricing capabilities supporting future growth

- Successful positioning of esure Flex as a budget-friendly option that doesn’t sacrifice on experience

Similar Case Studies

View All

We Built an AI Research Tool in a Month

We built Another Flock's AI research platform in just one month—from initial concept to live product. It gives teams instant synthetic user feedback on their ideas, designs, and marketing materials.

Using AI to Boost Online Impulse Buys

We worked with a global consumer goods company to tackle a big problem: people don't impulse-buy online like they do in physical stores. Together, we identified and prototyped AI solutions that suggest smart product combinations to shoppers, helping boost those spontaneous purchases.

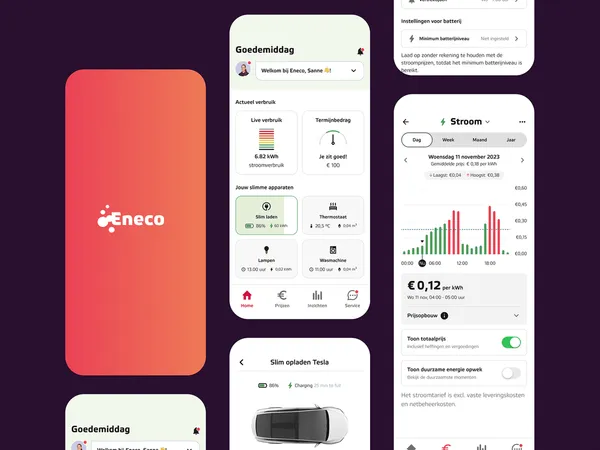

Launching a New Energy Pricing Model

We helped Eneco launch one of the Netherlands' first major dynamic energy tariffs in September 2023. Through user research, rapid prototyping, and brand work, we created a proposition that attracted environmentally conscious customers looking for more control over their energy costs.