When Software Giants Turned AI-First: 10 Companies That Successfully Pivoted

Rob Pisacane

Founder

Published Date

October 9, 2025

When Software Giants Turned AI-First: 10 Companies That Successfully Pivoted

The most successful AI pivots in recent years didn’t just add chatbots—they fundamentally reimagined their core products. Between 2022 and 2024, ten major companies across SaaS, productivity, e-commerce, and creative tools executed strategic transformations that made AI central to their value propositions rather than peripheral features. These pivots collectively generated billions in new revenue, with companies like Grammarly seeing 99% year-over-year growth and Salesforce processing over 1 trillion AI predictions weekly. What distinguishes these success stories is their willingness to reorganize entire companies, invest hundreds of millions in infrastructure, and fundamentally change how customers interact with their products. This wave of AI integration represented an existential pivot for many—particularly Grammarly and Intercom, which faced direct threats from ChatGPT and had to transform or risk obsolescence.

The timing matters: most pivots occurred within months of ChatGPT’s November 2022 launch, as executives recognized generative AI’s transformative potential. Companies that moved decisively between March 2023 and September 2024 captured market leadership, while those hesitating risked becoming commoditized. The results validate the risk—from Duolingo’s 40+ million daily active users to Canva’s $3.3 billion in annual recurring revenue, AI-first strategies delivered measurable business outcomes. But the journey wasn’t smooth: workforce reductions, quality concerns, customer backlash, and billion-dollar acquisitions marked the path to transformation.

Notion transformed productivity with AI-powered workspaces

Notion began in 2016 as a versatile productivity platform combining wikis, databases, and project management. For six years, it served as a “second brain” for manual information organization, growing steadily to millions of users without AI capabilities at its core.

The AI integration: In November 2022—just two weeks before ChatGPT’s public release—Notion launched its AI assistant in private alpha after executives prototyped features in a hotel room following a company offsite. The integration wasn’t superficial: AI became embedded directly into every page with spacebar activation, transforming the platform from passive storage to active intelligence. Notion AI leverages both GPT-4 and Claude models, providing contextual assistance that understands workspace knowledge, company style guides, and project history. The September 2025 launch of Notion 3.0 introduced autonomous AI Agents capable of executing multi-step tasks, creating databases at scale, and running on schedules—essentially becoming AI teammates rather than mere writing assistants.

Key capabilities: The platform now offers AI-powered search across connected apps (Slack, Google Drive, GitHub, Jira), database autofill that operates at scale, content generation and summarization, and question-answering that pulls from all workspace content. Agents can autonomously update hundreds of pages, schedule workflows, and retain memory for personalized assistance.

Remarkable results: Within weeks of the private alpha, 2+ million users joined the waitlist. The platform grew to over 100 million users by September 2024, with 86% of customers saying they’d be “very disappointed” if AI features disappeared. Most striking: 50%+ of customers now pay for AI features, up from 10-20% in 2022. The company crossed $500+ million in annualized revenue in September 2025 with revenue doubling year-over-year. Users save an average of 70+ minutes per week through automated summarization and task automation, while enterprise clients like Kaiser Permanente, Nvidia, and Volvo embraced the platform.

The transformation challenges: Technical complexity proved significant. Notion’s initial evaluation system relied on manual human review with JSONL files in git repositories, creating expensive, slow feedback loops that required building sophisticated automated evaluation infrastructure. The UX design demanded innovation—no good interactive writing interfaces existed for AI, forcing the team to create entirely new UI patterns. The spacebar entry point initially confused users by breaking established habits. Managing real-time performance as usage exploded required operating at millisecond scale, and the team built infrastructure to evaluate and switch between AI models within half a day when new models released. The company also faced decisions about making AI opt-in versus default, ultimately choosing default with enterprise toggle options, which created friction with some customers concerned about privacy.

Grammarly evolved from grammar checker to AI communication platform

Founded in 2009 by Ukrainian entrepreneurs, Grammarly spent over a decade as a subscription-based grammar and spell-checking tool primarily targeting students. The company offered basic grammatical error correction, browser extensions, and Microsoft Office integration, but remained fundamentally a revision tool rather than a generative composition platform.

The strategic necessity: ChatGPT’s November 2022 launch posed an existential threat. Users could simply paste text into ChatGPT for free corrections, while Google and Microsoft integrated AI natively into Docs and Office, eliminating the need for a separate grammar plugin. Revenue growth had already decelerated to just 1.44% year-over-year in 2022, signaling crisis. Within months, Grammarly executed one of tech’s most dramatic defensive pivots.

How AI became core: In March 2023, Grammarly announced GrammarlyGO at SXSW, integrating OpenAI’s GPT models to transform the product from revision-focused to supporting the entire communication lifecycle—conception, composition, revision, and comprehension. The integration worked where users already write across 500,000+ apps and websites, not requiring app switching. GrammarlyGO uses personal voice preferences, organizational brand guidelines, email context, and sender intent to generate tailored content. By August 2025, the platform launched specialized AI agents for citation finding, plagiarism detection, AI content detection, reader reactions, grading, and paraphrasing. The December 2024 Coda acquisition evolved Grammarly beyond writing assistance into a comprehensive AI productivity platform with document collaboration capabilities.

Business transformation: The impact was immediate and dramatic. Revenue grew 98.77% year-over-year in 2023 after the April GrammarlyGO launch, reversing the slowdown. The company reached an estimated $700 million in annual recurring revenue by May 2025. With 30-40 million daily active users, 96% of Fortune 500 companies have employees using Grammarly, and 70,000+ teams adopted the business version. Organizations save an average of $5,000 per employee annually (equivalent to 19 work days), achieving 17x ROI for enterprise deployments. A $1 billion financing round in May 2025 from General Catalyst enabled aggressive scaling and the Superhuman email client acquisition in July 2025.

Navigating existential challenges: The pivot arose from crisis, not opportunity. Native AI integration by competitors threatened Grammarly’s core business model, and their previously unique AI/ML capabilities became democratized overnight. Technical challenges included managing increased infrastructure costs from OpenAI API calls, requiring prompt limits (100 for free users, 2,000 for Premium, unlimited for Enterprise) to control expenses while maintaining 80% gross margins. The company faced positioning challenges, needing to evolve from “grammar checker” to “AI communication platform” through significant messaging overhaul. Academic markets worried about AI enabling cheating, prompting development of the Authorship tool to track writing provenance—though this tool itself proved “hit or miss” in accuracy. Early AI outputs were criticized as generic and disconnected from context, requiring substantial refinement to incorporate personalization and voice preferences. Despite challenges, the defensive pivot succeeded: Grammarly evolved from an at-risk single-use app into a comprehensive AI productivity platform acquiring complementary companies and commanding premium valuations.

Canva democratized design with comprehensive AI capabilities

Canva launched in January 2013 as a simplified graphic design platform for non-designers, offering drag-and-drop templates for social media graphics, presentations, and posters. For a decade, the platform’s core was template-based design with basic editing tools, growing from 750,000 users in 2013 to 150 million by 2023 on its original model.

AI becomes the design engine: In October 2023, Canva launched Magic Studio—described as the company’s “most game-changing launch ever” and the “world’s first all-in-one AI design offering.” The integration was transformative rather than additive: AI became the design engine itself. Instead of starting with blank canvases or templates, users generate custom designs from text prompts or uploaded media. Magic Studio consolidated all AI tools into a unified interface within Canva, eliminating platform switching. The platform leverages GPT-4 for text capabilities while partnering with DALL-E and Runway for image and video generation. The August 2024 acquisition of Leonardo.AI enhanced proprietary AI capabilities, and the April 2025 Visual Suite 2.0 expanded features further.

Comprehensive AI features: The Magic Studio suite includes Magic Design for complete custom designs from prompts, Magic Write (powered by OpenAI API) that’s generated over 10 billion words since 2022, Magic Switch for format conversion across 100+ languages, and Magic Media for image and video generation. Additional tools include Magic Edit, Magic Eraser, Magic Expand, Magic Grab for element isolation, and Magic Animate. Brand Kit with AI ensures all generated content follows brand guidelines. The 2024 Dream Lab standalone AI image generator uses Leonardo.AI’s Phoenix model with 15+ preset styles, while Canva Code generates interactive widgets without coding knowledge.

Explosive growth metrics: Canva’s AI products have been used over 5 billion times globally as of late 2023, growing to 10+ billion AI interactions by 2024. The user base expanded from 150 million monthly active users (2023) to 240+ million by August 2025. Revenue growth accelerated from $1.7 billion (2023) to $2.5 billion (2024) to $3.3 billion ARR (August 2025). The company’s valuation recovered from a $26 billion low to $42 billion by August 2025. Over 95% of Fortune 500 companies now use Canva, with 35 billion designs created since inception—376 designs every second. The education market alone has 60+ million active users, and university usage of Magic Studio increased 42% year-over-year.

Balancing complexity and simplicity: Canva’s reputation was built on simplicity, making the integration of powerful AI without overwhelming users a critical design challenge. The company had to ensure “various modalities—text, image, video—could work together effectively” while maintaining the accessible interface that made Canva beloved. Quality control required multi-layered safeguards and moderation systems to prevent inappropriate content generation. CEO Melanie Perkins identified that “the whole AI landscape is very fragmented today,” necessitating consolidation of multiple AI capabilities into a cohesive platform. Strategic decisions about building versus partnering led to relying on acquisitions (Kaleido.ai, Leonardo.AI) and OpenAI partnerships rather than building everything proprietary. The company committed $200 million to a Creator Compensation Program to pay creators whose content trains AI models, addressing ethical concerns. Environmental questions arose about the carbon impact of AI generation versus using existing stock photos. Enterprise customers demanded Canva Shield with advanced security, privacy controls, and indemnification for AI-generated content liability. Despite a valuation drop from $40 billion (2021) to $26 billion (2023) during market downturn, strategic AI investments positioned Canva for sustained growth.

Duolingo personalized language learning with AI tutoring

Duolingo was founded in 2011 by Carnegie Mellon professor Luis von Ahn and launched in 2012 as a gamified language-learning platform. The original product featured bite-sized lessons with spaced repetition, gamification elements (XP points, hearts, streaks, leaderboards), and human-created course content developed by linguists. For over a decade, lessons remained scripted and static with traditional assessment methods, growing to 25 million registered users by 2014.

From static lessons to adaptive AI tutoring: Duolingo began collaborating with OpenAI in September 2022 to integrate GPT-4 before its public launch. On March 14, 2023, the company launched Duolingo Max—a new premium tier powered by GPT-4—initially only on iOS in the US for Spanish and French courses. The integration transformed Duolingo from a static lesson platform to an adaptive, conversational learning system. AI analyzes 1.25 billion daily exercises to understand individual learning patterns and customize lessons in real-time. The proprietary “Birdbrain” AI system predicts user performance and adjusts difficulty dynamically, while conversational practice replaced scripted dialogues with free-flowing AI conversations that adapt to user responses.

Advanced AI capabilities: Duolingo Max’s signature features include Explain My Answer (context-specific explanations delivered via chatbot with interactive follow-up questions), Roleplay (interactive AI conversation practice with characters in scenarios like cafés and airports), and the groundbreaking Video Call with Lily launched September 2024 (real-time video conversations with an AI character that adapts to skill level). Research shows Video Call drove a 50% rise in Max subscriptions and measurably improves speaking skills. The platform expanded to 43+ languages with courses available in 28 UI languages. In April 2025, CEO Luis von Ahn declared Duolingo an “AI-first” company, announcing 148 new AI-generated courses completed in under one year—work that previously took 12 years.

Extraordinary user and revenue growth: Daily active users grew from 20.3 million (Q1 2023) to 47.7 million (Q2 2025)—a 135% increase. Monthly active users reached 128.3 million by Q2 2025. Paid subscribers increased from 4.8 million (Q1 2023) to 10.9 million (Q2 2025). Revenue grew 42% in Q1 2023 to 41% annually in 2024, reaching $748 million for the year. The company achieved record profitability with $88.6 million net income in 2024 and 42% free cash flow margin in Q4 2024. Stock price increased from $212.57 (August 2024) to $370.34 (August 2025)—a 74% gain. Over 20% of daily active users maintain streaks longer than one year, and the app became the #1 education app on both App Store and Google Play.

Social media backlash and strategic corrections: The AI transition sparked significant controversy. Approximately 10% of contract workforce was laid off in late 2023-early 2024, primarily translators and content creators, with some learning of termination through Slack access restrictions and poor communication. The April 2025 “AI-first” announcement generated massive social media backlash, with users flooding platforms with angry comments and threatening to abandon their streaks. Duolingo initially went silent, then posted a controversial TikTok mocking concerns, which was perceived as “punching down.” CEO von Ahn attempted to “reel back” statements after backlash. Technical quality issues emerged: GPT-4 explanations could be “occasionally inconsistent or lack nuance,” and conversational AI struggled with complex contexts, producing “glitchy or nonsensical responses.” By 2025, questions arose about content quality—whether AI-generated lessons matched human-created standards. Despite intense criticism, business metrics continued growing, though CEO acknowledged backlash caused growth at the “lower end” of guidance ranges. The company reduced “edgy posts” to improve social sentiment while maintaining that AI augments rather than replaces human educators. The controversy highlighted tensions between democratizing education and monetization strategy, as most advanced features remained locked behind the $30/month Max tier.

Shopify embedded AI throughout its commerce platform

Founded in 2006, Shopify established itself as a comprehensive e-commerce platform enabling merchants to create and manage online stores. For nearly two decades, the core product provided website hosting, payment processing, inventory management, marketing tools, and multi-channel commerce capabilities, serving millions of merchants from small businesses to enterprise brands without significant AI integration.

Making AI ubiquitous for merchants: On July 26, 2023, CEO Tobi Lütke announced Shopify Sidekick at Shopify Editions Summer 2023, with the announcement reaching 1.6 million views on Twitter. The integration made AI fundamental rather than peripheral: Shopify Magic embedded AI throughout the platform for product description generation, email creation, image editing, and marketing optimization. Sidekick functions as a business consultant providing real-time data analysis, multi-step reasoning for complex problems, integrated image generation, and natural language store management in 20 languages. The AI isn’t an add-on—it’s woven into core workflows, accessible wherever merchants see star icons in their admin interface. Following Lütke’s internal memo declaring “reflexive AI usage” as a baseline expectation, Shopify adopted Cursor (AI coding tool) and dramatically accelerated development velocity.

Comprehensive merchant capabilities: Shopify Magic handles content creation (product descriptions with SEO, email campaigns, blog posts, social media content), visual assets (background generation and replacement, product photography editing, logo and banner creation), business intelligence (customer cohort analysis with spending projections, sales trend diagnosis, inventory alerts), and operational automation (customer support responses, product recommendations, segmentation). Sidekick enables theme customization through natural language and generates code for custom blocks without coding knowledge. Shopify offered all features free to merchants across all subscription plans to drive platform stickiness and merchant growth rather than monetizing AI directly.

Platform growth and merchant success: Revenue grew 31% year-over-year to $2.7 billion in Q2 2025, with 27% growth in Q1 2025 and sustained 15-16% free cash flow margins for seven consecutive quarters. Gross Merchandise Volume (GMV) grew 22-31% across quarters in 2024-2025, with international markets showing 42% GMV growth and B2B commerce achieving 101-109% growth. Shop Pay GMV surged 57-65%, processing over $22 billion. The company achieved eight consecutive quarters of 25%+ revenue growth and seven consecutive quarters of GMV growth exceeding 20%. Shopify Payments penetration grew to 64% from 61%. Merchants report significant time savings on product listings, with companies like Brooklyn Tea founders noting AI “really does give you a shortcut to having some of these tools at your disposal.” Major enterprise wins included Starbucks, Canada Goose, Burton Snowboards, and Drake’s merchandise store. 117 of the Top 2,000 online retailers in North America use Shopify.

Implementation and adoption hurdles: Technical implementation posed complexity barriers for small-to-medium merchants lacking IT expertise, requiring Shopify to focus on intuitive, user-friendly interfaces. Data privacy and compliance with GDPR and CCPA regulations required balancing personalization with customer privacy through privacy-by-design principles—ensuring merchant store data isn’t shared between merchants. Shopify Magic uses each merchant’s own data exclusively for that merchant’s benefit with no cross-merchant data sharing. Cultural shifts proved challenging: CEO Lütke’s declaration of “reflexive AI usage” as baseline required significant organizational transformation. Early internal fears that AI adoption (especially tools like Cursor) would become too expensive had to be overcome. Change management required educating merchants on effective prompt writing and overcoming resistance from those hesitant about AI replacing human creativity. Market positioning challenges included balancing proliferation with monetization, particularly with price-sensitive freemium users. Content quality concerns arose around AI-generated outputs requiring human editing for brand voice consistency and the risk of repetitive content without customization. Shopify addressed challenges by maintaining free AI features, developing comprehensive documentation, building safety measures (Sidekick never makes changes without approval), investing heavily in compute infrastructure (partnering with GCP and neo-cloud providers like Nebius), and creating abstracted tooling to move between cloud providers for latest GPU access.

Adobe defended creative software dominance with Firefly

Adobe was founded in 1982 and established itself as the dominant creative software provider with flagship applications including Photoshop (image editing), Illustrator (vector graphics), Premiere Pro (video editing), and InDesign (publishing). Before the AI pivot, Adobe had invested over a decade in AI/ML through Adobe Sensei, powering features like Content Aware Fill and Neural Filters, but these were primarily enhancement tools rather than generative capabilities.

Integrating generative AI across creative workflows: On March 21, 2023, Adobe announced Firefly and Adobe Sensei GenAI at Adobe Summit. Firefly represents a family of generative AI models trained on Adobe Stock images, openly licensed content, and public domain material—designed for commercial safety with IP indemnification for enterprise customers. The integration was comprehensive: Firefly embedded directly into seven major Creative Cloud applications, with 75% of usage occurring within Photoshop and Illustrator rather than as standalone tools. Capabilities include text-to-image generation, Generative Fill (add, remove, or replace image elements), Generative Expand (extend images beyond borders), text effects, and generative recolor for vector artwork. Custom Models allow enterprise clients like IBM, Coca-Cola, and Mattel to train Firefly on proprietary brand assets.

Platform-wide AI capabilities: Adobe Sensei GenAI powers Experience Cloud with marketing copy generation, conversational experiences in Marketo Engage, AI-generated audience segments in Real-Time CDP, journey simulation, and automated caption generation in Customer Journey Analytics. Firefly Services APIs enable enterprise automation for generating thousands of localized marketing variations. Adobe Express integrates Firefly to enable non-technical teams (marketing, sales, HR, finance) to create brand-compliant content at scale. GenStudio for Performance Marketing provides end-to-end campaign creation and optimization. All outputs receive Content Credentials metadata showing AI involvement using the C2PA standard for transparency.

Massive adoption and revenue impact: Since March 2023 launch, Firefly powered over 16 billion generations by end of fiscal 2024, including 6.5+ billion images, 110 million text effects, 290+ million assets in Adobe Express, 60+ million vector creations in Illustrator, and 12 million asset imports into InDesign. Business performance showed FY2024 revenue of $21.51 billion (11% YoY growth), with Digital Media segment reaching $15.86 billion (12% YoY growth) and Document Cloud achieving $3.18 billion (18% YoY growth). Firefly drove 12% increase in Creative Cloud Monthly Active Users, with 43% of new subscribers activating Firefly within seven days. The platform showed 68% increase in engagement with Firefly-integrated tools, 21% increase in premium subscriptions attributed to Firefly, and 19% boost in conversion rates. Forrester Total Economic Impact Study projected ROI up to 577% for enterprises using Firefly-powered solutions. Firefly was estimated to generate over $500 million in ARR by mid-2025, with 61% from enterprise contracts and 11% of all Creative Cloud new ARR in 2024 from Firefly’s paid features.

Copyright controversy and competitive pressures: Major controversy erupted when a Bloomberg investigation revealed approximately 5% of Firefly’s training data came from AI-generated images from competitors like Midjourney (roughly 1.25 million of 248 million total images). This discovery undermined Adobe’s positioning as “ethically trained” and created trust issues despite Adobe offering full legal indemnification for enterprise customers. The debate highlighted legal uncertainty amid ongoing lawsuits against AI image generators for copyright infringement, and complex regulatory frameworks (EU AI Act versus U.S. approaches). Artist and creator concerns intensified: visual artists reported business “falling off a cliff,” and commercial copywriters experienced revenue pressure from AI tools. The ethical tension between “empowering creators” messaging and the reality that AI reduces demand for human creators in many scenarios created backlash. Technical limitations emerged: Firefly intentionally avoids copyrighted characters (e.g., Mickey Mouse), limiting utility for brands requiring such imagery unless they pay for private Custom Models. The failed $20 billion Figma acquisition terminated in Q4 2023 due to regulatory concerns cost Adobe a $1 billion termination fee and left the company vulnerable to competition from Figma’s design-centric alternative with lower team pricing. Market skepticism appeared in light FY2025 guidance ($23.3-23.55B) falling short of Wall Street expectations ($23.8B), suggesting AI monetization slower than hoped. Organizational challenges included ROI measurement difficulties (only 12% of organizations have proven AI ROI), fragmented ownership, budget constraints (33% of organizations report shortfalls), and $200 million foreign exchange headwinds in FY2025. Adobe addressed issues through IP indemnification programs, automatic Content Credentials application, Custom Models for proprietary training, multi-LLM strategy (including ChatGPT via Azure, Google’s FLAN-T5), diverse representation efforts to avoid bias, security architecture ensuring Adobe won’t train foundational models on customer business content, and Content Authenticity Initiative leadership establishing open standards.

Salesforce pioneered CRM AI with Einstein platform

Salesforce was founded in February 1999 by Marc Benioff and team as the world’s first 100% cloud-based CRM solution, pioneering the SaaS delivery model with the tagline “The End of Software.” For nearly two decades, the platform evolved from Sales Force Automation to a comprehensive customer platform with Sales Cloud, Service Cloud, Marketing Cloud, and other modules, becoming the #1 CRM provider globally before AI integration.

Einstein as foundational AI layer: On September 19, 2016, Salesforce announced Einstein at Dreamforce, embedding AI directly into the Salesforce Platform architecture at the platform level—not as a bolt-on solution. Einstein capabilities were integrated into fields, objects, workflows, and components across the entire platform, accessible through clicks (no-code) and code (for developers). The AI leverages all Salesforce data including customer data, Chatter activity, email, calendar, e-commerce, social data streams, and IoT signals. Automatic model customization occurs for every customer using their specific data, with self-tuning models that improve with every interaction. Cross-cloud availability spans Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Analytics Cloud, Community Cloud, and IoT Cloud.

Generative AI evolution: In March 2023, Salesforce announced Einstein GPT as the “world’s first generative AI for CRM,” integrating OpenAI’s ChatGPT with proprietary Einstein models and Data Cloud. September 2023 brought Einstein 1 Platform (unified data and AI) and Einstein Copilot (conversational AI assistant embedded in every CRM application). By September 2024, Agentforce succeeded the Einstein branding with autonomous AI agents. The Einstein Trust Layer provides secure AI architecture natively built into Salesforce that preserves data privacy while enabling AI across all clouds.

Comprehensive AI capabilities across clouds: Einstein for Sales Cloud provides predictive lead scoring (1-99 score), opportunity insights with alerts when deals trend up or down, automated activity capture, call summaries, sales assistants summarizing entire sales cycles, and AI-generated personalized emails using CRM data. Service Cloud features recommended case classification, recommended responses, predictive close times, Einstein Bots for self-service, reply recommendations, and search answers with knowledge base citations. Marketing Cloud offers predictive scoring, predictive audiences, automated send-time optimization, engagement scoring, and copy insights. Commerce Cloud includes product recommendations, predictive sort personalizing search results, and product description generation. Einstein Analytics provides Einstein Discovery (hidden pattern detection), Prediction Builder (custom prediction models), Next Best Action (AI-recommended next steps), and Smart Data Discovery finding insights from millions of data combinations.

Scale and market dominance: As of 2023, Einstein generates 200+ billion AI predictions per day and 1+ trillion predictions per week, serving millions of users daily. Salesforce remained #1 CRM provider for 11 consecutive years through 2024 and was added to the Dow Jones Industrial Average in August 2020. Revenue grew from $10.5 billion (FY2018) to $17+ billion (FY2020) and continued growing through the AI transition. Customer success examples include Fanatics achieving game-changing fan engagement across 300+ stores, RBC US Wealth Management realizing “huge operational efficiencies,” and S&P Global Ratings gaining deeper multi-dimensional market insights. Enterprise impact studies show 45% of executives increasing AI investments, early adopters freeing over 30% of employee time, and 95 of Fortune 100 companies trusting Salesforce.

Integration complexity and organizational challenges: Data integration complexity proved significant, requiring consistency across federated systems managing data from Azure, AWS, and on-premises simultaneously while creating unified views with data remaining in original locations. Major system transitions occurred, such as an Indian financial services company moving a 15-year-old system in just three months. User adoption resistance emerged with employees fearing change, sales teams overwhelmed by new interfaces, and low enthusiasm from teams accustomed to traditional methods. Customization overload created risks of excessive platform changes, balancing flexibility with performance, and managing scope creep (e.g., sales projects expanding to marketing). Skills gaps demanded extensive data science expertise, specialized predictive model building capabilities, infrastructure support, and complex integration knowledge. Strategic timing challenges appeared when agentic AI emerged, requiring a “hard pivot” with leadership working to refine vision around functionality, value, and measurable success. Competitive pressure intensified as ServiceNow “chipped away at lower end of ServiceCloud buyers,” demanding accelerated innovation. Business challenges included data quality issues (duplicate records, incomplete fields, obsolete information requiring validation rules and automation), change management across organizations, clear pricing structures for new AI features, and ethical considerations around bias, fairness, privacy, and responsible deployment. Salesforce implemented solutions including the Einstein Trust Layer for data privacy and security, Copilot Analytics for tracking adoption and ROI, extensive Trailhead training, phased rollout approaches, customer success programs, and partner ecosystem development.

HubSpot pivoted from inbound marketing to AI-powered growth

HubSpot was founded in 2006 by Brian Halligan and Dharmesh Shah at MIT, coining the term “inbound marketing” and building a platform around attracting customers through valuable content rather than interrupting them with ads. For nearly two decades, the core product focused on website optimization, blogging, social media management, SEO, and lead generation. The 2014 launch of HubSpot Free CRM and subsequent Service Hub expanded the platform beyond marketing, but the fundamental approach remained manual until the AI pivot.

Native AI integration replacing standalone tools: On March 6, 2023, HubSpot announced ChatSpot and Content Assistant, initially launching ChatSpot as a standalone public alpha powered by OpenAI’s ChatGPT and DALL-E 2. However, the company quickly integrated ChatSpot into the HubSpot platform rather than keeping it separate. The major transformation came September 18, 2024, at INBOUND 2024, when HubSpot unveiled the Breeze AI platform with over 200 platform updates. Breeze represents complete reimagining as embedded AI throughout the entire customer platform: Breeze Copilot (fully integrated AI assistant across web, mobile, and browser extensions), Breeze Agents (autonomous AI workers for specific workflows), and Breeze Intelligence (native data enrichment with 200+ million buyer and company profiles from acquired Clearbit).

Comprehensive AI capabilities: Breeze Copilot provides chat-based assistance across all HubSpot products for content generation, email and conversation summarization, prospect research, meeting preparation, and custom assistants trainable on business processes. Breeze Agents (33 total) include seven marketing agents (Content Agent generating blogs and podcasts, Social Media Agent creating posts), six sales agents (Prospecting Agent for personalized outreach at scale), five customer service agents (Customer Agent handling inquiries 24/7 resolving 58-73% of tickets autonomously with 75% customer satisfaction and multilingual support), and data agents researching CRM data, transcripts, and web sources. The platform includes 80+ embedded AI features covering content remix for video, lead scoring, sales forecasting, email optimization, form shortening, and predictive analytics. Breeze Intelligence provides automatic contact/company record enrichment, buyer intent signals, form shortening, high-fit prospect identification, and 3x more visibility into high-intent prospects.

Documented customer ROI: The impact has been substantial across HubSpot’s 250,000+ businesses. Agicap saved 750 hours per week across the organization with 20% increase in deal velocity and 100% CRM adoption. Sandler saw 25% increase in new prospect engagement and 60% more SQLs from marketing with 4x sales leads. Kaplan Early Learning handled 37% of 1,800 chat requests without human intervention in Q1 implementation. Flipsnack reduced human-led conversations by almost half (from 7,600 to 3,034). FBA published 2,000-word articles daily—a 250% increase—while maintaining distinct brand voice. Youth on Course handled 75% more support tickets with 16% improved response time and 7% boost in customer satisfaction. Platform-wide metrics show 90% of high-growth company leaders already using AI, over 47,000 users on the agent.ai network, and 1,700+ builders signed up to create agents.

Data quality and governance challenges: The AI transition revealed that AI is “only as good as the data you feed into it,” requiring clean, accurate data free from errors and biases. As the CEO of UEGroup noted, “Providing valuable AI solution has a lot to do with the data available, not the technology.” Eliminating siloed data and ensuring good access to all customer touchpoints proved essential. Platform migration complexity emerged as ChatSpot evolved from standalone to integrated, requiring all users to create or attach HubSpot accounts, with prompt limits removed and settings changed. Context and governance limitations meant early AI couldn’t digest governance guides or CRM policies—it could create contacts without knowing mandatory properties or create deals without understanding required fields. The AI replicated processes but didn’t understand “why.” Change management proved challenging as marketing, sales, and service teams remained “apprehensive” about AI, viewing it as “potentially disruptive” and feeling they “lack the right resources.” Marketing was viewed as “most eager but least prepared in terms of skill sets,” while customer service had “most AI use cases but least enthusiastic about adoption.” Strategic challenges included technology evolution speed (rapid advancement from ChatSpot to Breeze in 18 months, GPT-3 to GPT-4 transition one month after ChatSpot launch), positioning and messaging (rebranding from “HubSpot AI” to “Breeze”), competitive landscape pressures, and product strategy decisions about building versus partnering. Privacy and security concerns arose from ChatGPT usage raising data privacy questions and “it’s not private” concerns from enterprise customers. Cost and value justification required determining pricing for AI features across different tiers and proving ROI. HubSpot implemented solutions including phased rollout with beta/alpha programs and customer feedback loops, HubSpot Academy courses on AI, INBOUND conference education, built-in AI trust and safety measures with transparent model cards, deep integration versus bolt-on approach using Smart CRM as foundation, and customer success programs with case study development and ROI calculators.

Dropbox reimagined cloud storage as AI knowledge management

Dropbox was founded in 2007 as a cloud file storage and synchronization service, solving the problem of forgetting USB thumb drives by storing files in the cloud accessible from any device. For over 15 years, the company’s core product centered on syncing files across devices and sharing content in the cloud without significant intelligence or search capabilities.

Universal search as strategic transformation: On June 21, 2023, CEO Drew Houston announced Dropbox Dash and Dropbox AI, describing this as addressing “the 2024 version” of Dropbox’s original problem—content scattered everywhere making it hard to find. The integration represented a fundamental strategic pivot: transforming from simple cloud storage to an AI-powered knowledge management and universal search platform. Dropbox Dash functions as an AI-powered universal search connecting all tools, content, and apps in a single search bar, becoming the company’s flagship AI product. Built on retrieval-augmented generation (RAG) and AI agents architecture, the platform uses machine learning to evolve and improve with usage while creating a “teamwork graph” to understand organizational knowledge.

AI-powered productivity features: Dropbox Dash provides universal search across Google Workspace, Microsoft Outlook, Salesforce, and 30+ other platforms from one interface. Stacks offer AI-organized smart collections for links and content, while the Start Page provides an AI-powered dashboard surfacing relevant work and shortcuts. The Answers feature generates AI responses with follow-up questions and surfaces related content. Users can summarize documents, videos, and meetings with one click, and ask questions about file content without opening files. October 2024 brought Dash for Business, extending enterprise capabilities. Dropbox AI applies to file previews for summarizing and answering questions about content. AI-powered permission management across multiple cloud apps came via the Nira acquisition. Critically, Dropbox self-hosts AI by default, ensuring customer data stays within Dropbox rather than being shared with third parties.

Platform scale and strategic bets: The platform is trusted by 700+ million registered users worldwide, with early partner McLaren Racing calling it a “game-changer.” Knowledge workers previously spent 8.8 hours per week looking for files, and 69% spent up to 60 minutes daily navigating between apps—problems Dash directly addresses. 90% of Klarna employees using AI tools became a reference case for enterprise adoption. The company launched a $50 million Dropbox Ventures fund to support AI startups and acquired Nira (content governance platform) in 2024 to enhance security features. CEO Drew Houston featured Dash prominently in interviews as core to Dropbox’s future strategy, signaling the company’s complete commitment to the AI transformation.

Market skepticism and trust hurdles: Market skepticism emerged with some viewing the pivot as “glomming onto the AI bandwagon” given Dropbox’s status as a mature, established company. Competitive pressure intensified as Dropbox operated in a crowded AI productivity space against Microsoft, Google, and AI-native startups. Trust and privacy concerns required transparent AI Principles and explicit commitment not to sell customer data or use it for training third-party models. Technical complexity in building RAG and multi-step AI agents for business environments with diverse, fragmented data proved substantial. User adoption challenges emerged from needing to convince users to change established workflows and trust AI with sensitive business data. Security requirements from enterprise customers demanded granular access controls and data governance. Resource allocation pressures mounted with the CEO acknowledging pressure to stay relevant in the AI era while maintaining the core business. Integration challenges involved connecting 30+ different platforms with varying APIs and data structures. Despite these challenges, Dropbox’s decision to make AI central to its value proposition rather than a peripheral feature positioned the company for relevance in an AI-powered productivity landscape.

Klarna transformed payments into AI-powered shopping assistance

Founded in 2005, Klarna built its business as a “buy now, pay later” (BNPL) fintech company providing flexible payment solutions for online shopping. The Swedish firm allowed consumers to split purchases into installments, and for nearly 18 years, Klarna’s core value proposition was payment flexibility rather than AI or shopping assistance.

Becoming AI-first fintech: CEO Sebastian Siemiatkowski immediately recognized ChatGPT’s potential upon its November 2022 launch. In March 2023, Klarna became the first European company and first fintech globally to launch a ChatGPT plugin. By January 2024, Klarna launched its AI assistant powered by OpenAI for customer-facing interactions, and September 19, 2024, brought enhanced AI assistant with chat-based shopping capabilities. The transformation was comprehensive: AI integrated across the entire customer journey from product discovery to customer service to financial management. Internally, Klarna made ChatGPT Enterprise available to all employees, fundamentally changing operations. CEO Siemiatkowski became an evangelist for AI transformation, positioning Klarna as an “AI-powered global payments network and shopping assistant.”

Customer service and shopping AI: The AI assistant handles customer service in 35+ languages across 23 markets, managing refunds, returns, and payment inquiries autonomously 24/7. Shopping AI provides product search and recommendations based on preferences and history, price comparison across 5.6 million products from thousands of stores, product comparison with AI-generated pros and cons, visual search identifying 10+ million items via camera (Shopping Lens), expert advice and category/brand comparisons, customer review analysis, and shoppable video content. Internal AI (Kiki) answers 2,000 employee questions daily with 85% employee adoption and 250,000+ inquiries processed.

Dramatic early results and strategic reversal: First-month results (January 2024) showed 2.3 million conversations handled, with two-thirds of customer service chats managed by AI—work equivalent to 700 full-time agents. AI performance matched human agents in customer satisfaction while achieving a 25% drop in repeat inquiries due to better accuracy. Customer resolution time fell to under 2 minutes versus 11 minutes previously, contributing to an estimated $40 million profit improvement for 2024. Over 1,000 employees were reduced through natural attrition (2023-2024) as AI took over functions. The platform serves 150 million consumers worldwide with 2.5 million daily transactions and 85 million active users. However, by 2025, the CEO admitted that cost focus led to “lower quality” customer service, and Klarna began hiring human customer service agents again after disappointment with the AI-only approach, realizing AI couldn’t handle all customer scenarios, especially complex or sensitive issues.

Over-automation backlash and course correction: Quality issues emerged as the over-automation strategy revealed limitations. The strategic reversal by 2025—hiring human agents after touting AI replacement—created public perception challenges. Initial claims about replacing 700 agents faced criticism and scrutiny. The company had to find the right balance between AI automation and human touch, acknowledging that “really investing in the quality of the human support is the way of the future for us” (CEO quote). Regulatory concerns in the highly regulated financial services sector proved challenging, as did fraud and compliance scenarios requiring human oversight. Employee morale suffered from workforce reductions creating uncertainty. Implementation speed required constant adaptation as rapid changes rolled out. Market positioning shifted from “AI will replace humans” to “AI augments humans” narrative. Technical limitations became apparent as AI struggled with nuanced financial situations requiring empathy. The Klarna experience provides a cautionary tale: aggressive AI automation delivered impressive initial metrics but proved unsustainable for quality customer experience, requiring hybrid approaches combining AI efficiency with human judgment for complex, sensitive, or high-stakes interactions.

The transformation patterns and lessons learned

These ten companies—spanning productivity tools, creative software, CRM, e-commerce, education, and fintech—reveal consistent patterns in successful AI pivots. Executive commitment proved essential: every successful transformation had CEO-level championing, from Notion’s founders prototyping in hotel rooms to HubSpot’s comprehensive Breeze rebrand to Intercom’s $100 million commitment. Timing mattered immensely: companies that moved decisively between March 2023 and September 2024, leveraging GPT-3.5/GPT-4 breakthroughs immediately after ChatGPT’s November 2022 launch, captured market leadership. Core integration distinguished winners from laggards: successful companies made AI central to their products rather than peripheral features, embedding capabilities directly into workflows where users already work.

OpenAI partnerships dominated the landscape, with nine of ten companies leveraging OpenAI technology, though most maintained model-agnostic architectures to avoid lock-in. Speed of execution from announcement to production ranged from 2-6 months, with companies like Notion launching private alpha within two weeks. The results validated aggressive investment: Grammarly’s 99% year-over-year revenue growth, Salesforce’s 1+ trillion weekly predictions, Canva’s $3.3 billion ARR, Duolingo’s 135% DAU growth, and Adobe’s 16+ billion generations demonstrated massive adoption and business impact.

Common challenges emerged across all transformations. Trust and privacy concerns required transparent data practices, with every company facing customer questions about data security and third-party AI model usage. Quality versus automation created tensions—Klarna’s experience showed aggressive automation without quality oversight risks backlash and strategic reversal. Change management proved difficult, requiring restructuring of organizations and workflows, with companies like Intercom expanding ML teams from under 10 to nearly 50 people. Cost management demanded significant infrastructure and talent investment, including billion-dollar acquisitions (Atlassian’s DX) and hundred-million-dollar commitments (Intercom’s $100M replatforming). Competitive pressure intensified as companies raced against tech giants and AI-native startups—Grammarly faced existential threats from native Google and Microsoft AI.

The most successful pivots shared distinct characteristics. They treated AI as platform transformation, not feature addition—reorganizing entire companies around AI rather than bolting capabilities onto existing products. They moved from defensive to offensive postures—while some pivots began as defensive responses to ChatGPT threats (Grammarly, Dropbox), success required embracing offensive strategies creating new value propositions. Outcome-based pricing emerged as innovative business model, with Intercom charging 99 cents per successful resolution rather than seat-based subscriptions. Hybrid human-AI approaches proved most sustainable—Klarna’s AI-only strategy failed, while companies maintaining human oversight for complex scenarios succeeded. Continuous model evaluation became competitive advantage—Notion’s infrastructure to switch between models within half a day and Intercom’s rigorous offline testing and live A/B trials enabled rapid adaptation.

The transformations also revealed when AI integration fails. Klarna’s initial over-automation without quality oversight led to customer satisfaction issues requiring strategic reversal. Duolingo’s poor communication around contractor layoffs and tone-deaf social media responses generated massive backlash despite strong business metrics. Adobe’s training data controversy—using 5% AI-generated images from competitors—undermined ethical positioning despite strong product performance. These failures highlight that technical success alone doesn’t guarantee sustainable transformation; companies must navigate workforce transitions, customer communication, ethical sourcing, and quality assurance simultaneously.

The workforce implications varied dramatically. Some companies expanded teams (Canva grew 40%, Intercom grew ML teams 5x), while others reduced workforces (Klarna cut 1,000+ employees, Duolingo laid off 10% of contractors). The most successful approaches treated AI as augmentation rather than replacement, creating new roles (Conversation Designer, Health Center Manager, Automation Specialists) rather than simply eliminating positions. Companies that communicated transparently about workforce changes and invested in upskilling maintained better employee morale and public perception.

Industry-specific lessons emerged from the diverse sectors represented. Productivity tools (Notion, Dropbox, HubSpot, Atlassian) successfully positioned AI as enabling humans to focus on high-value work rather than administrative tasks. Creative software (Canva, Adobe) faced unique ethical challenges around copyright, training data, and artist displacement, requiring IP indemnification and content provenance solutions. Customer service platforms (Intercom, Klarna, HubSpot) found AI excelled at routine inquiries but struggled with complex, emotional, or high-stakes situations requiring hybrid approaches. Education (Duolingo) balanced democratization missions with premium AI monetization, creating tensions around accessibility. CRM and marketing platforms (Salesforce, HubSpot) leveraged decades of customer data to create context-aware AI that understood business workflows and industry-specific needs.

The technical architecture patterns showed convergence around several key elements: retrieval-augmented generation (RAG) for grounding AI in proprietary knowledge bases, multi-model strategies for rapid adaptation as new models released, trust layers ensuring data privacy and security for enterprise customers, and federated data approaches allowing AI to work across multiple systems while data remained in original locations. Companies that built these architectural foundations early could iterate rapidly on features, while those treating AI as simple API integration struggled with quality, performance, and enterprise requirements.

Monetization strategies diverged based on market position and competitive dynamics. Shopify offered AI free across all plans to drive platform stickiness and merchant GMV growth (where Shopify earns transaction fees). Duolingo and Grammarly created premium tiers with advanced AI features, successfully converting free users to paid subscribers. Salesforce and HubSpot bundled AI into existing plans to drive account expansion and reduce churn. Adobe used AI to drive Creative Cloud subscription upgrades and enterprise contract expansions. Intercom pioneered outcome-based pricing (pay per resolution), aligning costs with customer value. The most successful approaches aligned AI monetization with core business models rather than treating AI as separate revenue stream.

Strategic imperatives for the AI era

These transformations reveal that AI pivots represent existential business decisions, not incremental feature additions. Companies that recognized this reality early—treating AI integration as fundamental platform transformation requiring CEO-level commitment, organizational restructuring, and hundred-million-dollar investments—captured market leadership and sustained growth. Those that approached AI as another feature release risked commoditization and competitive displacement.

Speed and decisiveness determined winners. The window between ChatGPT’s November 2022 launch and mid-2024 represented a critical period when established companies could execute AI pivots before markets consolidated. Companies launching major AI initiatives within 6-9 months of ChatGPT (Notion, Grammarly, Canva, Salesforce, HubSpot) achieved outsized adoption and revenue growth. Those hesitating or moving cautiously faced intensified competitive pressure from both AI-native startups and fast-moving incumbents.

The quality-speed tradeoff proved critical. Klarna’s experience demonstrates that moving too fast without quality oversight creates unsustainable customer experiences requiring costly reversals. Conversely, perfectionism risks market timing failures. Successful companies adopted iterative approaches: launching beta/alpha programs, gathering rapid customer feedback, implementing rigorous evaluation frameworks, and continuously improving based on real-world usage. Notion’s evolution from simple writing assistant to autonomous agents, and HubSpot’s progression from ChatSpot to comprehensive Breeze platform exemplify iterative approaches that balanced speed with quality.

Ethical considerations became competitive differentiators. Adobe’s copyright controversy showed that training data practices matter for brand trust and enterprise sales, even if they don’t immediately impact product quality. Companies proactively addressing ethics—through transparent sourcing, content provenance tracking (Content Credentials), IP indemnification, creator compensation programs, and bias mitigation—built sustainable competitive advantages. Those treating ethics as afterthoughts faced backlash, regulatory scrutiny, and customer hesitation.

The most profound insight: AI transforms not just products but entire business models and organizational structures. Intercom evolved from Software as a Service to “Service as Software,” Shopify repositioned from e-commerce platform to AI-powered commerce operating system, and Grammarly transformed from revision tool to comprehensive communication platform. These weren’t branding exercises—they represented fundamental shifts in value propositions, pricing models, customer relationships, and competitive positioning. The companies that recognized AI’s potential to redefine not just how products work but what problems they solve achieved the most dramatic transformations and the strongest market positions entering the AI era.

What we've worked on lately.

View All

We Built an AI Research Tool in a Month

We built Another Flock's AI research platform in just one month—from initial concept to live product. It gives teams instant synthetic user feedback on their ideas, designs, and marketing materials.

Using AI to Boost Online Impulse Buys

We worked with a global consumer goods company to tackle a big problem: people don't impulse-buy online like they do in physical stores. Together, we identified and prototyped AI solutions that suggest smart product combinations to shoppers, helping boost those spontaneous purchases.

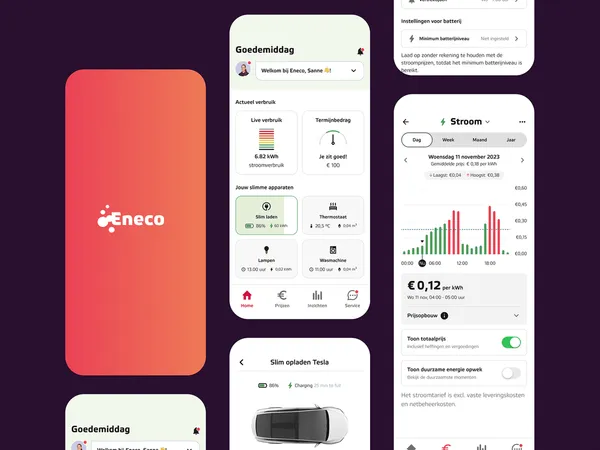

Launching a New Energy Pricing Model

We helped Eneco launch one of the Netherlands' first major dynamic energy tariffs in September 2023. Through user research, rapid prototyping, and brand work, we created a proposition that attracted environmentally conscious customers looking for more control over their energy costs.

"Nesta worked with The Product Bridge throughout 2024 to build and scale our Visit a Heat Pump service, transforming it from a proof of concept into a live, nationwide offering."

Alasdair Hiscock

Design Lead, Nesta